The CIPD’s latest Reward Management survey report reveals that UK employers need to work harder to ensure that low-paid workers have easy access to employee benefits that could help increase their spending power and protect them from poverty.

With 38% of employers planning to increase their spend on benefits in the next year, the CIPD is urging them to make sure it’s money well spent.

Too many people are struggling to make ends meet

A survey of 2,500 employees revealed the fragile state of employee financial wellbeing and found that, for too many people in the UK, work is not a reliable route out of poverty:

- Around one in eight (12%) say their pay is not enough to support an acceptable standard of living.

- One in ten find it a constant struggle to keep up with bills and credit commitments.

- More than a quarter (27%) report their pay is not enough to cope with a £300 emergency.

- One in four say money worries impact their work.

With the cost of living rising at a worrying rate, the CIPD is urging employers to do what they can to better support financial wellbeing. Along with paying a fair and liveable wage, providing the right employee benefits – ensuring they are inclusive and accessible – is crucial to helping people escape poverty.

Better communication could help ensure your benefits budget is money well spent

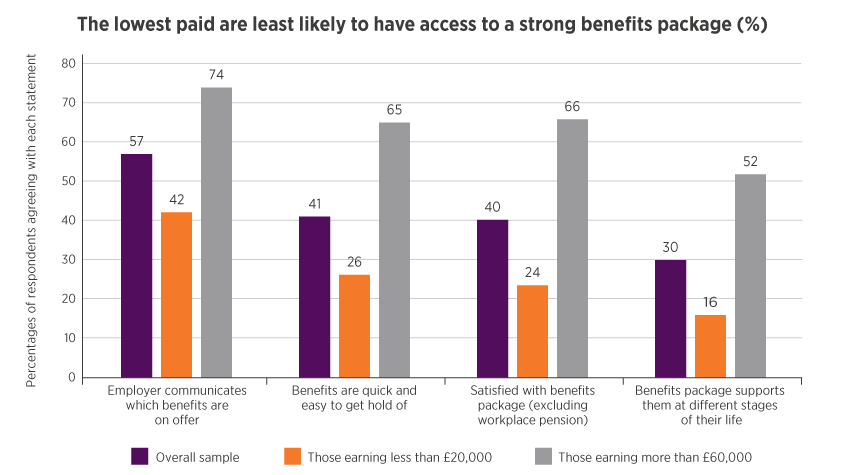

The right benefits can help to offset the 'poverty premium', increase your people’s spending power, and protect them from financial shocks. The good news? 60% of employers say they offer a good benefits package and 38% are planning to increase their benefits budget in the next year. But just 40% of employees say they’re happy with the benefits on offer and only 41% say they are easy to access.

The survey also found that those on the lowest incomes, who could most stand to gain from a strong employee benefits package, are the least likely to know what benefits are on offer and how to access them - resulting in much lower levels of satisfaction with the benefits package.

Employers offer a wide range of benefits, but could do more to help the lowest paid

The CIPD’s research shows that employers offer a wide range of benefits that contribute to making work a more reliable route of poverty – not just tangible ‘in-kind’ perks, but also less tangible benefits such as flexible working and training and development, both of which can help people increase their earning potential.

But those on low incomes appear to have fewer benefits available to them. For example:

- 92% of employers offer some sort of training and development opportunities as part of their benefits package, but only 47% offer specific opportunities to help low-earners progress and increase their income.

- 73% of employers offer occupational sick pay but only 41% of low-waged workers say they would receive their usual pay if they had to take ten days off sick. Other health and wellbeing related benefits, such as critical illness insurance, private medical insurance and healthcare cash plans, are less common and are more likely to only be offered to certain employees (depending on job, location or pay grade, for example). The CIPD’s Good Work Index shows that the lower paid are less likely to have access to flexible working options such as flexi-time or working from home.

Certain ‘fringe’ benefits could help offset the ‘poverty premium’

Several so-called ‘fringe’ benefits that help offset the cost of housing, travel and childcare can be of particular value to those on the lowest incomes. For example, interest-free loans or subsidies can help people to avoid the ‘poverty premium’ they would otherwise pay if they can’t afford to get the best deals by paying for goods and services upfront.

Relatively few employers offer such benefits currently, but the CIPD’s survey of employers suggests we could see some of these increasing in coming years:

- 53% of employers offer childcare vouchers*, but just 5% of offer subsidised childcare through on-site crèches and less than a quarter offer paid time off for emergency childcare (23%).

- 51% of employers offer cycle to work salary sacrifice schemes that enable employees to save money on the cost of a bike and spread the payments over time. But just 30% offer loans for travel season tickets.

- 43% of employers offer discount cards or vouchers to help with the cost of shopping.

- 13% of employers offer loans or subsidies to help with the purchase or set-up of technology and telecoms products and services.

- 20% of employers provide interest-free loans to help employees in times of hardship or to cover the costs non-work-related house moves.

- 14% enable employees to access their earned wage before their regular pay day and 5% allow employees to choose how often they are paid.

A formal commitment to supporting financial wellbeing is a much-valued benefit

Another important aspect of a benefits package is helping employees to better manage their finances and providing support in times of difficulty. The CIPD’s YouGov survey showed that employees not only value the idea of having a financial wellbeing policy at work, but are also much more likely to be satisfied with their overall benefits package if their employer has such a policy in place:

- 65% of employees say it’s important that their future employer has a financial wellbeing policy, rising to 81% of those whose current employer has one in place.

- Those already covered by a financial wellbeing policy are more than twice as likely to be satisfied with the benefits package (70% versus 28%) and three times as likely to agree that the benefits package supports them at different stages of their life (60% versus 19%).

Although only 18% of employers currently have a financial wellbeing policy in place, 78% say they do offer an employee assistance programme and 41% offer free financial education, guidance, or advice.

Employers already investing in such benefits should consider communicating this as part of a holistic financial wellbeing policy, to help ensure staff know how to access these services and how they could help them. Employers who can’t offer such benefits could instead easily sign-post free and independent advice and guidance, such as that offered by the Money and Pensions Service.

Charles Cotton, Senior Policy Adviser on Performance and Reward at the CIPD, comments:

‘Protecting people from in-work poverty goes beyond paying a fair and liveable wage. Employee benefits can make a valuable difference to living standards, but those at most risk of in-work poverty seem to be the least likely to be covered by a financial wellbeing policy or benefits package that meets their needs. Some employers may not even need to introduce new perks – they may just need to work harder to ensure employees know what’s on offer, how it will help them, and how to access existing benefits.’

Top five tips for communicating about benefits

- Target communications carefully, choosing the most relevant message, sensitive tone and effective channel for different segments of your workforce.

- Where possible, relate and time your communications to relevant external events or personal life stages such as illness, becoming a parent or preparing for retirement.

- Use a range of communication channels – don’t rely on online portals or other digital channels unless everyone in your workforce has easy access to these.

- Upskill managers so that they can talk confidently with their teams about the benefits on offer, the value they bring and how to access them.

- Get to know what makes your workforce tick and adapt your communications strategy accordingly. Think broadly about what constitutes a benefit for different groups of your workforce: different people value different things and this may change over time, depending on their personal circumstances.

* Childcare vouchers offer tax savings when paid for through salary sacrifice. These are now being superseded by the Government’s tax-free childcare scheme but are still available for those pre-enrolled in existing schemes before September 2018.

Media centre

Are you a journalist looking for expert commentary and insights on the world of work?

23 فبراير, 2024

Winners revealed for the CIPD HR Awards in Ireland 2024

23 أكتوبر, 2023

Extended deadline to enter CIPD HR Awards in Ireland 2024

Championing better work and working lives

About the CIPD

At the CIPD, we champion better work and working lives. We help organisations to thrive by focusing on their people, supporting economies and society for the future. We lead debate as the voice for everyone wanting a better world of work.